Is it a bad thing? A good thing? Or something that can be considered neither good or bad?

Inflation, at its most basic level, is the declining purchasing power of a specific currency over a period of time. This happens when the value of a currency falls and the general level of the price of goods and services rise. Typically the goods and services used to measure the price changes are those that humans need the most, and buy most often. These purchases include food (such as bread and milk), fuel, energy, transportation (think cars and mass transit), healthcare and entertainment products like televisions.

Inflation numbers seek to present a value representation to this increase in the price of common goods and services over a finite period of time, allowing economists and the public to gain an understanding of the average consumer’s real purchasing power. At a micro level, this loss of purchasing power means people are spending more of their overall budget on common purchases, essentially increasing their cost of living. In a macro sense, economists become concerned when inflation rates rise too high, too quickly, or when the rates are wildly different than what was expected. These scenarios, economists most fear, lead to a deceleration in economic growth or worse.

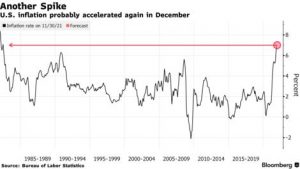

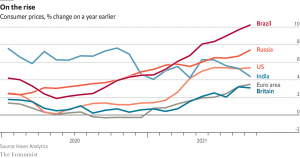

The United States finds itself in one of these predicaments as it enters 2022. The U.S. Bureau of Labor Statistics reported that the Consumer Price Index (CPI) was up by 7% in the twelve-month period ending in December 2021. This percentage increase has not been seen in the U.S. since the period ending June 1982. As the COVID-19 pandemic has impacted all aspects of global life, the economy was not immune. Many look at the pandemic, countries’ response to it, and its effects as the culprit for this significant inflationary rise. Historically, economists point to two major mechanisms for inflation.

The first is demand-pull inflation, which occurs when an increase in supply of money and credit stimulates overall demand for goods and services in an economy to increase more rapidly than the economy’s production capacity. In a nod to demand-pull inflation, some national leaders, economists and pundits reference the COVID relief packages passed by the government, coupled with supply-chain issues as the primary driver of the 7% increase. Another well-tread theory is cost-push inflation, which is a result of the increase in prices working through the production process inputs. Some of the national stage refer to this theory as they attribute the current inflation to rising prices caused by the difficulty of companies obtaining certain raw materials, again associated with the supply-chain issues plaguing most of 2021.

As there is no consensus as to how inflation or hyperinflation occurs, there are no agreed upon solutions either. Economists and others suggest a wide variety of strategies, many of which have been implemented in the past. Some of these strategies include raising interest rates, drastic cuts in government spending, price controls on staple goods and services and bond-buying programs. Currently, the United States government and the Federal Reserve are determining what its next steps will be to address this issue.

This week’s Current Events resources explore inflation. The resources shared provide background and current national conversations around inflation, as its year-long rate was its highest since the early 1980’s.

Looking for more current events resources? Sign up at our We the Teachers Educator Resource Community page, where you can find all of our Current Events, and learn about our other programs!

Essential Questions, Vocabulary & Extend the Resources:

- What is inflation?

- Should there be a negative or positive association to the term inflation? Explain.

- According to most economists, what are the primary drivers of inflation?

- What are the actions a federal government, such as the United States, can take in order to address concerns about rising levels of inflation?

- What other ‘actors’ are integral in addressing the concerns over rising levels of inflation?

- What are the short and long term effects of rising inflation and the actions that may be taken in addressing inflation?

- What are the similarities and differences in the Keynesian understanding and approach to inflation and Milton Friedman’s?

Click here for a hardcopy of the Essential Questions & Inflation Vocabulary

Click here for a hardcopy of the Extend the Resources handout with suggested lesson activities and extensions

Videos:

Podcasts:

The beef over price controls, The Indicator from Planet Money, January 12, 2022

Understanding inflation with Fadhel Kaboub, Macro & Cheese, December 15, 2021

Inflation is still surging and some Democrats see one culprit: Greedy companies, Morning Edition, NPR, January 12, 2022

Inflation Soars to Fastest Pace in Four Decades, What’s New, The Wall Street Journal, January 12, 2022

Background Resources:

Inflation: Prices on the Rise, International Monetary Fund

Inflation explained in 3 charts, Axios

Inflation (CPI), The Organisation for Economic Co-operation and Development

Recent Articles:

White House allies split over inflation plan as Biden focuses on corporate greed, The Washington Post, January 10, 2022

December inflation breakdown: Where are rising prices hitting consumers the hardest?, Fox Business, January 12, 2022

Despite higher wages, inflation gave the average worker a 2.4% pay cut last year, CNBC, January 12, 2022

Gold gains as dollar retreats after U.S. inflation data, Reuters, January 12, 2022

Welcoming immigrants would cool off inflation, US Chamber of Commerce CEO says, CNN, January 11, 2022

Inflation rises 7% over the past year, highest since 1982, CNBC, January 12, 2022

What economists are saying about the highest inflation in nearly 40 years, Yahoo Finance, January 12, 2022

Recent Editorials:

Here’s where the inflation came from in 2021, Market Watch, January 12, 2022

Inflation Heresies, Project Syndicate, January 11, 2022

Price Controls and Government Spending Won’t Fix Inflation, Newsweek, January 12, 2022

The Year of Inflation Infamy, New York Times, December 16, 2021

Images & Infographics:

Lesson Plans:

Money and Inflation, Foundation for Teaching Economics

What causes inflation?, Econedlink

The Impact of Inflation, Rutgers University

Understanding Inflation: A Stop Motion Explainer, PBS Learning

Banks, Credit & the Economy, iCivics

Inflation, Global Youth Program, Wharton School, University of Pennsylvania

Media & News Literacy Lesson Plans:

Media Literacy Resources – Newseum

News & Media Literacy Lessons – Common Sense

Media Misinformation, Viral Deception, and “Fake News” – University of Wyoming

Evaluating Sources in a ‘Post-Truth’ World: Ideas for Teaching and Learning About Fake News – New York Times Lessons